SDGs for SRI investors – Eurosif’s survey findings

In 2015, world leaders from different sectors came together to agree on three major sustainability mandates: The Addis Ababa Action Agenda, the 2030 Sustainable Development Agenda, and the Paris Agreement on Climate Change. The basis of those Agreements represents the blueprint for a global stable and sustainable society. Resources and investments need to pour in from all sides and all parties for this to become a reality. How can we mobilise the private sector and how can we make sure we scale up the efforts required to increase the flow of capital to finance the Agenda? What does an SDG investor look like?

Today, several practitioners apply at least some form of extra-financial evaluation in their portfolio. By that we mean the process of considering environmental, social and governance (ESG) criteria in the portfolio construction. This process follows the recognition of ESG issues to be entirely material and part of the financial evaluation. Though this is not sufficient to fall under an SRI denomination or to meet the requirements of one specific strategy, it can be seen very much in alignment with financing the Sustainable Development Goals (SDGs) Agenda. The ESG efforts by the various private actors are consistent with the SDGs, but need to be leveraged further to achieve stronger outcomes. SDG investors can opt to take ESG criteria into consideration to have a positive societal impact, targeting financial returns which can range from below market to market rate returns, committing to both measure and report the social and environmental performance and progress of underlying investments.

The need to capitalise on the private sector’s resources represents an opportunity for investors who are already keen on SRI. Eurosif believes that there are a number of SRI strategies that can be helpful in attaining goals in line with the SDGs. We recently launched a survey, asking investors which strategy was most relevant for the SDG objectives and which of the SDGs are most meaningful in terms of increasing investors’ impact.

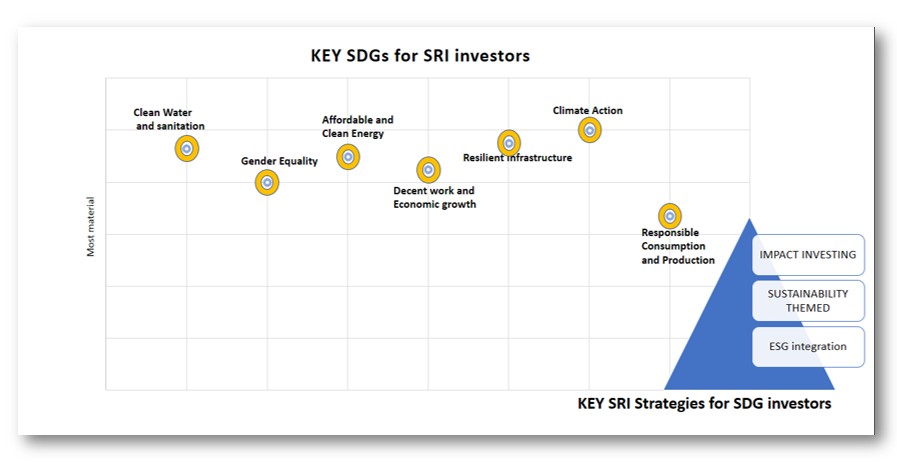

Below are the results of the survey, which indicate that the most relevant strategy focus lay with SDGs 6, 5, 7, 8, 9, and to a lesser degree SDG 12. Above all is the fight against climate change, the undisputed SDG 13. The most relevant SRI strategies are Impact Investing, Sustainability Themed investments and ESG Integration. Impact Investing is an SDGs favourite as it offers the possibility to quantify the impact and outcome of a particular strategy. Sustainability Themed investments are still very much associated with climate objectives and therefore indicate a positive correlation with those investors eyeing up SDG 13 in particular. Those in favour of ESG Integration mainly named the importance of taking a holistic approach to the SDGs and therefore the relevance of applying ESG consideration.

For more information on how Eurosif considers SDGs for SRI investors, read our SDG Overview available here.