EU Taxonomy

Regulation (EU) 2020/852, known as the Taxonomy Regulation, establishes a framework to facilitate sustainable investment. It aims to create a ‘green list’ of environmentally sustainable economic activities.

The Taxonomy Regulation was conceived as an investment tool that would facilitate sustainable investments. Using scientific criteria, it aims to create a ‘green list’ of economic activities by identifying and defining those that qualify as environmentally sustainable.

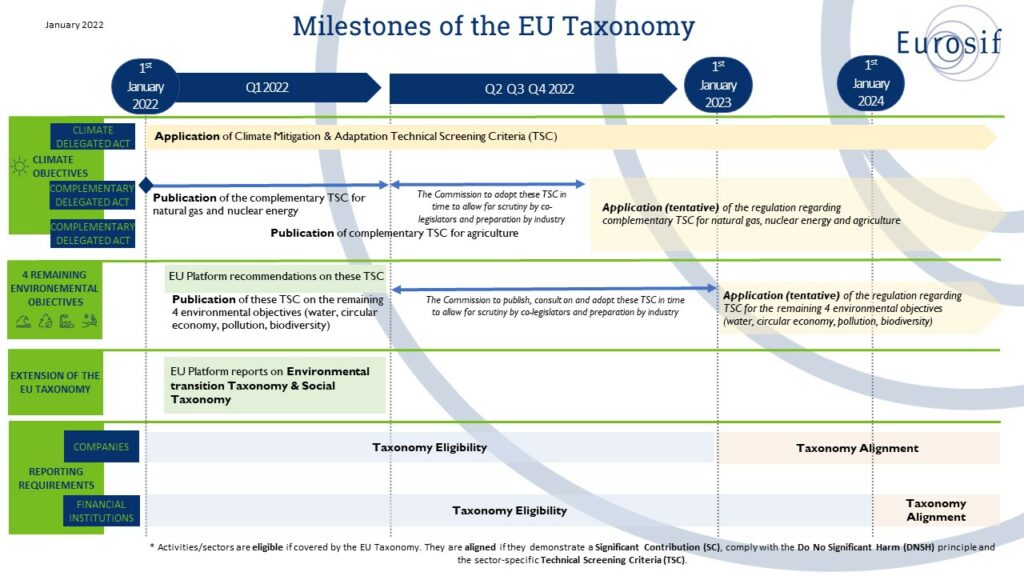

The European Commission, based on the input of a dedicated group of expert stakeholders, the Platform on Sustainable Finance (PSF), has put forward several Delegated Acts to specify the Technical Screening Criteria (TSC) for different economic activities, based on their significant contribution to environmental objectives: climate change adaptation and mitigation, but also protection of marine resources, transition to a circular economy, pollution prevention and control, and protection and restoration of biodiversity.

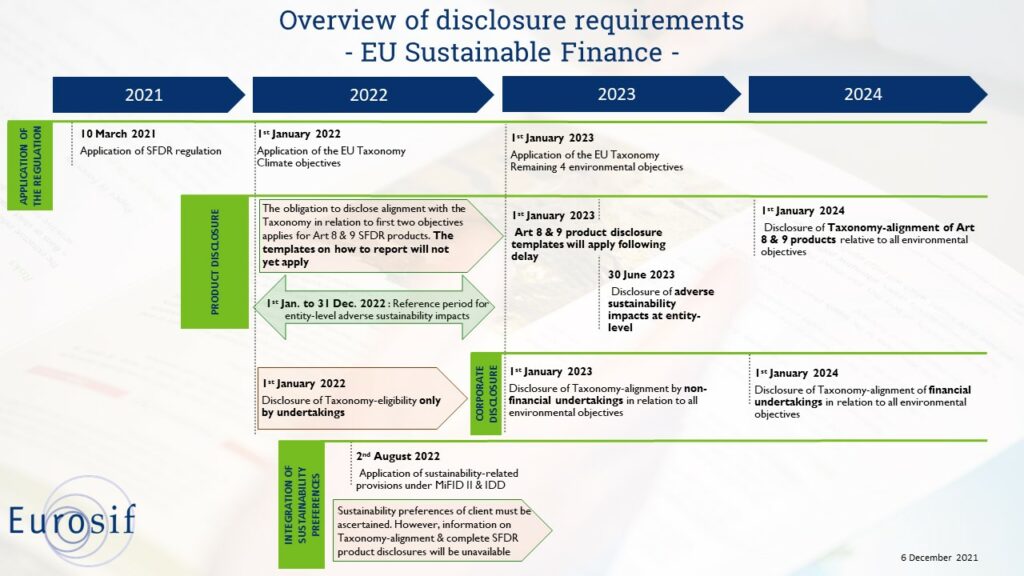

Use of the Taxonomy is largely voluntary, however the disclosure of Taxonomy alignment activities is required under other pieces of EU sustainable finance legislation. Moreover, Article 8 of the Taxonomy Regulation requires listed and large financial and non-financial companies to report indicators on their business activities’ or, where relevant, their investments’ eligibility and alignment with the Taxonomy.